When the Rules Change, Only the Adaptable Win

Editor’s Note: Markets evolve – sometimes, it’s a crawl… and others, a leap.

We’re mid-leap right now. Stocks are moving faster, data is flowing wider, and the old playbook just doesn’t cut it anymore.

That’s why Louis Navellier, one of the most accomplished quantitative investors in America, is teaming up with two forward-thinking analysts – Andy and Landon Swan – to introduce “The Ultimate Stock Strategy.”

It combines Louis’ proven Stock Grader model with cutting-edge online sentiment analytics, creating a system designed for this new market environment.

They’ll reveal how it works live on October 28 at 10 a.m. Eastern.

Read on for more on how this next-generation strategy came together – and how to use it to your advantage…

A lot has changed since I launched my first newsletter in 1980.

Back then, investing required patience – and paper.

If you wanted a stock quote, you unfolded The Wall Street Journal or squinted at the fine print in your local paper. To trade, you picked up your landline phone, called your broker, and paid up to $50 for him to execute your trade.

Then you waited for the confirmation slip to arrive in the mail.

There wasn’t much financial media, either.

CNBC didn’t exist. If you were serious about the markets, you tuned in to Wall $treet Week With Louis Rukeyser on Friday night. Though most didn’t. Only about 1 in 10 Americans owned stocks.

No 24-hour news. No online brokers. No internet. Market data moved by fax, not fiber-optic cable.

Today, that world feels quaint… prehistoric, even.

Stock quotes now refresh by the second. Commissions have fallen from $50 to zero. You can trade anything from your phone before breakfast.

The Wall Street Journal and Barron’s still matter. But news now moves faster – and to more people – than ever before. Nearly the entire flow of market information has migrated online.

Think about it. A single post from President Donald Trump or Elon Musk can send entire markets soaring or plunging in seconds.

And an entirely new group of younger, highly online investors is making its presence felt. In 2021, a wave of Reddit traders sent GameStop Corp. (GME) up more than 1,700% in less than a month, forcing multibillion-dollar hedge funds to scramble to cover their short positions.

The point is: If you’re still investing the old way, you’re flying blind.

Because if you don’t know how to make sense of all that online chatter, someone else will.

And it’s not always a Wall Street pro. It might be a college kid turning $500 into $80,000 by spotting viral sentiment before the crowd (this actually happened, by the way).

In short, there are powerful new sources of market intelligence out there – but many investors my age haven’t learned how to use them.

Those who do have a serious edge.

That’s why, on October 28 at 10 a.m. Eastern, I’ll reveal a major new use of my Stock Grader model… a fusion of my quantitative stock-picking method with powerful new online data. It’s a breakthrough designed to help you thrive in this new, faster market.

Over that time, Stock Grader and I have found 676 stocks that could have doubled your money or better – including 22 that went up more than 100-fold.

But this new integration could lead to even more double- and triple-digit stock recommendations.

More importantly, it could add zeroes to your net worth.

How AI Is Redefining Modern Investing

That’s not to say my “old world” strategy has lost its edge. It’s every bit as powerful as when I first developed it as a grad student in the 1970s.

With the help of a mainframe computer owned by Wells Fargo bank, I built a model portfolio designed to track the S&P 500 using just 320 stocks.

Only it didn’t just track the index – it beat it.

According to the academic theory of the day, that wasn’t supposed to happen. So I dug deeper, ran the numbers, and found a pattern that changed the course of my career.

Some stocks, I discovered, move independently of the broader market. They have their own rhythm – their own signal. And when you isolate them early, they can deliver outsized returns.

Ever since, I’ve used this insight to build Stock Grader and other quantitative models that have powered some of the most successful investment advisories in America.

It’s helped me deliver returns most investors didn’t think possible – and do it consistently.

Not only have I had success with stock recommendations, but also my mutual funds and ETFs have been ranked #1 by Morningstar and The Wall Street Journal.

And from 1998 to 2024, my Growth Investor advisory service (previously called Blue Chip Growth) more than doubled the average annual return of the S&P 500.

The New York Times even called me an “icon among growth investors” for the impact my quantitative approach has had on Wall Street.

I’m humbled by all of that. But I don’t believe in sitting on my laurels.

I’m always looking for the next “edge” in the market.

And I think I found it…

What comes next could be even more important – for every investor who still believes in adapting to win.

Turning Online Sentiment Into Profits

I won’t go into too much detail here. I’ll reveal everything during my October 28 event (click here to reserve your spot for that free broadcast).

What I can say is that this system was developed by two brilliant young investors whose investing approach has been studied by top academics at Georgetown University.

They’ve figured out how to tap into a powerful new form of online data – the kind of information that moves markets long before earnings reports do.

None of this existed when I got started. And unless you work for a hedge fund – or already subscribe to these young men’s research – I’m willing to bet you haven’t seen what this kind of edge can do for your returns.

Sure, you might have an account with some of these websites… Facebook… X… Reddit… YouTube… and so forth.

But even then, it’s next to impossible to know who to follow, or how to make sense of it all.

Take two recent gains these young men made for their subscribers last month by tapping into this new source of information.

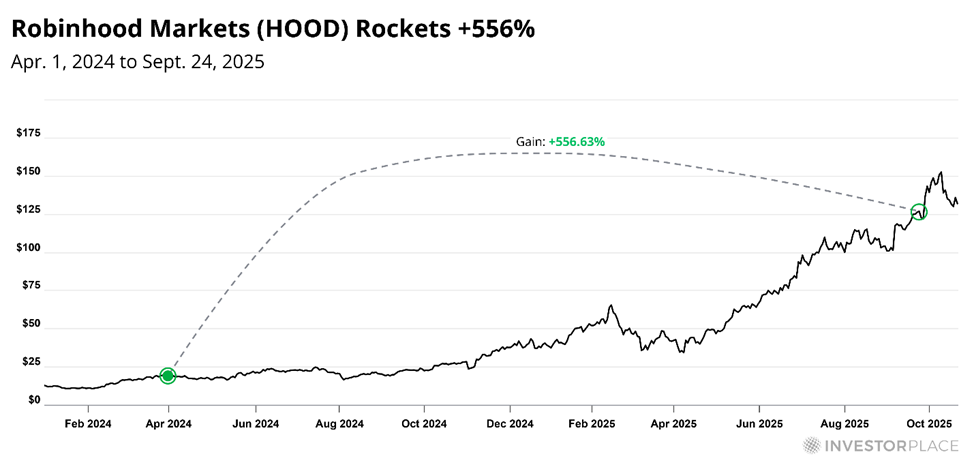

The first was Robinhood Markets Inc. (HOOD), which they sold from their model portfolio after a 557% profit in 17 months. They recommended this trade because they could read online sentiment before it showed up in the earnings reports.

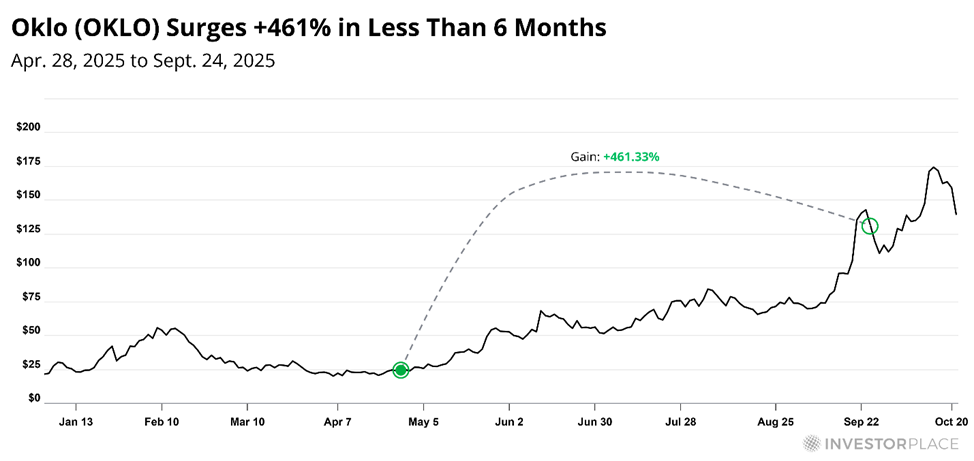

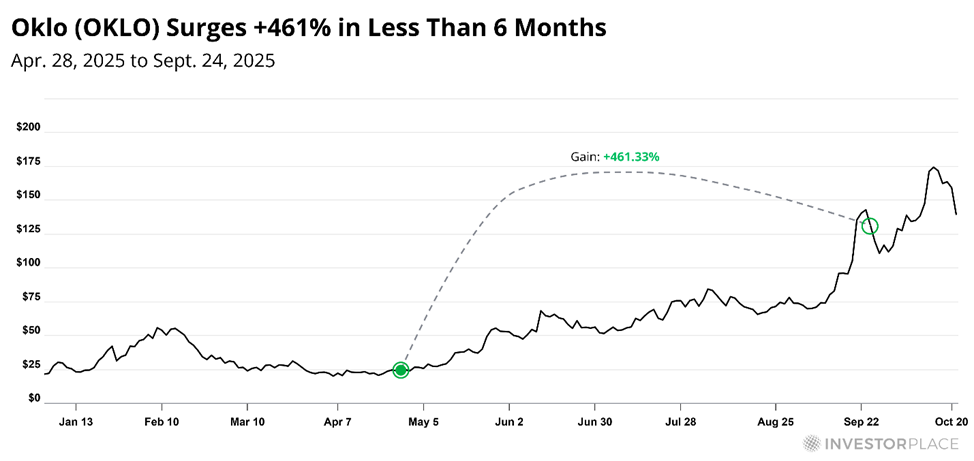

The second was small nuclear reactor maker Oklo Inc. (OKLO). Last month, they sold it for a 461% gain just six months after they recommended it. Again, online sentiment tipped them off to this trade.

Now, here’s where things get really interesting…

When you combine this powerful source of online information with my Stock Grader system, the results are jaw-dropping.

AI-Powered Investing Results: 240 Potential Doubles in Five Years

We’re not just talking about a handful of lucky trades.

In our backtesting, this strategy would have spotted more than 240 doubles gains over five years… for an average gain of 244%.

That’s why we’re calling it the Ultimate Stock Strategy. It combines my tried-and-tested Stock Grader system with their online sentiment signals.

To help you get started understanding how Ultimate Stock Strategy works, and what makes it so powerful, I’m granting sneak-peek access to my Stock Grader tool for the next few days.

By analyzing a stock’s financial strength and market momentum, Stock Grader can help you see which companies are worth your attention – and which aren’t.

Stock Grader normally costs $1,000 a year. But it’s yours free for a limited time as a thank-you for signing up for the event on October 28.

You can type in any ticker you’d like and instantly see how high – or how low – my system ranks it.

You’ll also get updates on the new Ultimate Stock Strategy that incorporates those online sentiment signals I mentioned…

We believe the same signals that recently led to a 6X windfall on HOOD and another 5X on OKLO, together with Stock Grader, could lead to at least one double-your-money winner by Christmas.

We’ll reveal everything live on October 28 at 10 a.m. Eastern.

Here’s the link to get started.

The Editor hereby discloses that as of the date of this article, the Editor, directly or indirectly, owns the following securities that are the subject of the commentary, analysis, opinions, advice, or recommendations in, or which are otherwise mentioned in, the essay set forth:

Robinhood Markets, Inc. (HOOD)